Feature Articles

- Small Business and the Affordable Care Act

- Hobby or Business? Why It Matters

- Which Moving Expenses are Deductible?

Tax Tips

- Reduce Your Taxes with Miscellaneous Deductions

- Tips on Travel While Giving to Charity

- Six Tips on Gambling Income and Losses

- Tips for Self-Employed Taxpayers

QuickBooks Tips

This newsletter is intended to provide generalized information that is appropriate in certain situations. It is not intended or written to be used, and it cannot be used by the recipient, for the purpose of avoiding federal tax penalties that may be imposed on any taxpayer. The contents of this newsletter should not be acted upon without specific professional guidance. Please call us if you have questions.

Small Business and the Affordable Care Act

Whether you’re self-employed or run a small business, here’s a quick look at what you need to know about the Affordable Care Act.

Self-Employed

If you run an income-generating business with no employees, then you’re considered self-employed. You can get coverage through the Healthcare Marketplace and use it to find coverage that fits your needs.

Note: You are still considered self-employed even if you hire independent contractors to do work for you.

If you currently have individual insurance–a plan you bought yourself and not the kind you get through an employer–you may be able to change to a Marketplace plan.

Note: You can’t be denied coverage or charged more because you have a pre-existing health condition.

Small Businesses (50 or Fewer Employees)

If you have 50 or fewer full-time equivalent (FTE) employees (generally, workers whose income you report on a W-2 at the end of the year) you are considered a small business under the health care law.

As a small business, you may get insurance for yourself and your employees through the SHOP (Small Business Health Options Programs) Marketplace. This applies to non-profit organizations as well.

Note: Beginning in 2016, the SHOP Marketplace will be open to employers with 100 or fewer FTEs.

As an employer, you must provide notification to your employees of coverage options available through the Marketplace and are required to provide this notice to all current employees and to each new employee regardless of plan enrollment status or full or part-time employment. The Department of Labor has sample notices that employers can use to comply with this regulation. One notice is for employers who do not offer a health care plan and the second for employers who offer a health care plan.

If you have fewer than 25 employees, you may qualify for the Small Business Tax Credit (see next section). Non-profit organizations may be eligible for the tax credit as well.

Small Business Health Care Tax Credit

Small businesses and tax-exempt organization that employ 25 or fewer, full-time equivalent workers with average incomes of $50,000 or less, and that pay at least half (50 percent) of the premiums for employee health insurance coverage are eligible for the Small Business Health Care Tax Credit.

Starting in 2014, the tax credit is worth up to 50 percent of your contribution toward employees’ premium costs (up to 3 percent for tax-exempt employers). The tax credit is highest for companies with fewer than 10 employees who are paid an average of $25,000 or less. The smaller the business, the bigger the credit is.

For tax years 2010 through 2013, the maximum credit was 35 percent for small business employers and 25 percent for small tax-exempt employers such as charities.

Businesses that have already filed and later find that they qualified in 2013 or an earlier year can still claim the credit by filing an amended return for the affected years. A three-year statute of limitations normally applies to these refund claims.

Note: The credit is available only if you get coverage through the SHOP Marketplace and is available to eligible employers for two consecutive taxable years.

If you are a small business employer who did not owe tax during the year, you can carry the credit back or forward to other tax years. In addition, because the amount of the health insurance premium payments is more than the total credit, eligible small businesses can still claim a business expense deduction for the premiums in excess of the credit–in other words, both a credit and a deduction for employee premium payments.

The credit is refundable for small tax-exempt employers as well, so even if you have no taxable income, you may be eligible to receive the credit as a refund as long as it does not exceed your income tax withholding and Medicare tax liability.

Additional Tax on Businesses Not Offering Minimum Essential Coverage

Effective January 1, 2015 an additional tax will be levied on businesses with 100 or more full-time equivalent (FTE) employees that do not offer minimum essential coverage. However, it will not apply until 2016 to employers with at least 50 but fewer than 100 full-time employees.

Employers subject to the employer responsibility provisions in 2015 must offer coverage to at least 70 percent of full-time employees as one of the conditions for avoiding an assessable payment, rather than 95 percent which begins in 2016.

This penalty is sometimes referred to as the Employer Shared Responsibility Payment.

You may have to pay this additional tax if you have 50 or more full-time equivalent employees and at least one of your full-time employees gets lower costs on their monthly premiums through the Marketplace.

Note: Employers with fewer than 50 FTE employees are considered small businesses and are exempt from the additional tax.

The amount of the annual Employer Shared Responsibility Payment is based partly on whether you offer insurance.

- If you don’t offer insurance, the annual payment is $2000 per full-time employee (excluding the first 30 employees for business with 50-99 full time employees and excluding the first 80 employees for those with 100 or more full time employees)

Note: For purposes of this calculation, a full-time employee does not include a full-time equivalent.

- If you do offer insurance, but the insurance doesn’t meet the minimum requirements, the annual payment is the lesser of $3000 per full-time employee who qualifies for premium savings in the Marketplace or $2,000 per full-time employee (minus 30 full-time employees).

Note: Unlike employer contributions to employee premiums, the Employer Shared Responsibility Payment is not tax deductible.

A health plan meets minimum value if it covers at least 60 percent of the total allowed costs of benefits provided under the plan. To determine whether other coverage meets minimum value, please contact us for assistance.

Note: All plans in the Marketplace meet minimum value, so any coverage offered through the SHOP Marketplace should qualify.

Excise Tax on High Cost Employer-Sponsored Insurance

Effective in 2018, a 40 percent excise tax indexed for inflation will be imposed on employers with insurance plans where the annual premium exceeds $10,200 (individual) or $27,500 (family). For retirees age 55 and older, the premium levels are higher, $11,850 for individuals and $30,950 for families.

Excise Tax on Medical Devices

Effective January 1, 2014, a 2.3 percent tax will be levied on manufacturers and importers on the sale of certain medical devices.

Indoor Tanning Services

A 10 percent excise tax on indoor tanning services went into effect on July 1, 2010. The tax doesn’t apply to phototherapy services performed by a licensed medical professional on his or her premises. There’s also an exception for certain physical fitness facilities that offer tanning as an incidental service to members without a separately identifiable fee.

Don’t hesitate to call us if you need assistance navigating the complexities of the new health care act. We’re here to help.

Hobby or Business? Why It Matters

Millions of Americans have hobbies such as sewing, woodworking, fishing, gardening, stamp and coin collecting, but when that hobby starts to turn a profit, it might just be considered a business by the IRS.

Definition of a Hobby vs. a Business

The IRS defines a hobby as an activity that is not pursued for profit. A business, on the other hand, is an activity that is carried out with the reasonable expectation of earning a profit.

The tax considerations are different for each activity so it’s important for taxpayers to determine whether an activity is engaged in for profit as a business or is just a hobby for personal enjoyment.

Of course, you must report and pay tax on income from almost all sources, including hobbies. But when it comes to deductions such as expenses and losses, the two activities differ in their tax implications.

Is Your Hobby Actually a Business?

If you’re not sure whether you’re running a business or simply enjoying a hobby, here are nine factors you should consider:

- Whether you carry on the activity in a businesslike manner.

- Whether the time and effort you put into the activity indicate you intend to make it profitable.

- Whether you depend on income from the activity for your livelihood.

- Whether your losses are due to circumstances beyond your control (or are normal in the startup phase of your type of business).

- Whether you change your methods of operation in an attempt to improve profitability.

- Whether you, or your advisors, have the knowledge needed to carry on the activity as a successful business.

- Whether you were successful in making a profit in similar activities in the past.

- Whether the activity makes a profit in some years, and how much profit it makes.

- Whether you can expect to make a future profit from the appreciation of the assets used in the activity.

An activity is presumed to be for profit if it makes a profit in at least three of the last five tax years, including the current year (or at least two of the last seven years for activities that consist primarily of breeding, showing, training, or racing horses).

The IRS says that it looks at all facts when determining whether a hobby is for pleasure or business, but the profit test is the primary one. If the activity earned income in three out of the last five years, it is for profit. If the activity does not meet the profit test, the IRS will take an individualized look at the facts of your activity using the list of questions above to determine whether it’s a business or a hobby. (It should be noted that this list is not all-inclusive.)

Business Activity: If the activity is determined to be a business, you can deduct ordinary and necessary expenses for the operation of the business on a Schedule C or C-EZ on your Form 1040 without considerations for percentage limitations. An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is appropriate for your business.

Hobby: If an activity is a hobby, not for profit, losses from that activity may not be used to offset other income. You can only deduct expenses up to the amount of income earned from the hobby. These expenses, with other miscellaneous expenses, are itemized on Schedule A and must also meet the 2 percent limitation of your adjusted gross income in order to be deducted.

What Are Allowable Hobby Deductions?

If your activity is not carried on for profit, allowable deductions cannot exceed the gross receipts for the activity.

Note: Internal Revenue Code Section 183 (Activities Not Engaged in for Profit) limits deductions that can be claimed when an activity is not engaged in for profit. IRC 183 is sometimes referred to as the “hobby loss rule.”

Deductions for hobby activities are claimed as itemized deductions on Schedule A, Form 1040. These deductions must be taken in the following order and only to the extent stated in each of three categories:

- Deductions that a taxpayer may claim for certain personal expenses, such as home mortgage interest and taxes, may be taken in full.

- Deductions that don’t result in an adjustment to the basis of property, such as advertising, insurance premiums, and wages, may be taken next, to the extent gross income for the activity is more than the deductions from the first category.

- Deductions that reduce the basis of property, such as depreciation and amortization, are taken last, but only to the extent gross income for the activity is more than the deductions taken in the first two categories.

If your hobby is regularly generating income, it could make tax sense for you to consider it a business because you might be able to lower your taxes and take certain deductions.

Still wondering whether your hobby is actually a business? Give us a call and we’ll help you figure it out.

Which Moving Expenses are Deductible?

If you moved due to a change in your job or business location or because you started a new job or business, you may be able to deduct your reasonable moving expenses.

Additionally, if you meet the requirements of the tax law for the deduction of moving expenses, you can deduct allowable expenses for a move to the area of a new main job location within the United States or its possessions. Your move may be from one United States location to another or from a foreign country to the United States.

Note: The rules applicable to moving within or to the United States are different from the rules that apply to moves outside the United States. These rules are discussed separately.

To qualify for the moving expense deduction, you must satisfy three requirements.

Under the first requirement, your move must closely relate to the start of work. Generally, you can consider moving expenses within one year of the date you first report to work at a new job location. Additional rules apply to this requirement. Please contact us if you need assistance understanding this requirement.

The second requirement is the “distance test”; your new workplace must be at least 50 miles farther from your old home than your old job location was from your old home. For example, if your old main job location was 12 miles from your former home, your new main job location must be at least 62 miles from that former home. If you had no previous workplace, your new job location must be at least 50 miles from your old home.

The third requirement is the “time test.” If you are an employee, you must work full-time for at least 39 weeks during the first 12 months immediately following your arrival in the general area of your new job location.

If you are self-employed, you must work full time for at least 39 weeks during the first 12 months and for a total of at least 78 weeks during the first 24 months immediately following your arrival in the general area of your new work location.

There are exceptions to the time test in case of death, disability and involuntary separation, among other things.

If your income tax return is due before you have satisfied this requirement, you can still deduct your allowable moving expenses if you expect to meet the time test.

Note: If you are a member of the armed forces and your move was due to a military order and permanent change of station, you do not have to satisfy the “distance or time tests”.

What Are “Reasonable” Expenses?

You can deduct only those expenses that are reasonable under the circumstances of your move. For example, the cost of traveling from your former home to your new one should be by the shortest, most direct route available by conventional transportation. If during your trip to your new home, you make side trips for sight-seeing, the additional expenses for your side trips are not deductible as moving expenses. And, you cannot deduct your travel meal costs.

You can deduct the cost of packing, crating and transporting your household goods and personal property, and you may be able to include the cost of storing and insuring these items while in transit. You may also deduct costs of connecting or disconnecting utilities.

Tip: You can include the cost of storing and insuring household goods and personal effects within any period of 30 consecutive days after the day your things are moved from your former home and before they are delivered to your new home.

Tip: You can deduct the cost of shipping your car and your pets to your new home.

Nondeductible expenses. You cannot deduct as moving expenses any part of the purchase price of your new home, the costs of buying or selling a home, or the cost of entering into or breaking a lease. Don’t hesitate to call us if you have any questions about which expenses are deductible.

Reimbursed expenses. If, at a later date, your employer reimburses you for the costs of a move for which you took a deduction, you may have to include the reimbursement as income on your tax return. Report any taxable amount on your tax return in the year you get the payment.

Travel Expenses – How to Calculate the Deduction

If you use your car to take yourself, members of your household, or your personal effects to your new home, you can figure your expenses by deducting either:

- Your actual expenses, such as gas and oil for your car, if you keep an accurate record of each expense, or

- The standard mileage rate is 23.5 cents per mile for miles driven during 2014.

Tip: If you choose the standard mileage rate you can deduct parking fees and tolls you pay in moving. You cannot deduct any general repairs, general maintenance, insurance, or depreciation for your car.

You can deduct the cost of transportation and lodging for yourself and members of your household while traveling from your former home to your new home. This includes expenses for the day you arrive. You can include any lodging expenses you had in the area of your former home within one day after you could not live in your former home because your furniture had been moved. You can deduct expenses for only one trip to your new home for yourself and members of your household; however, all of you do not have to travel together.

Member of Your Household

You can deduct moving expenses you pay for yourself and members of your household. A member of your household is anyone who has both your former and new home as his or her home. It does not include a tenant or employee, unless you can claim that person as a dependent.

Reporting Address Changes

When you move, be sure to update your address with the U.S. Post Office as well as the IRS. Use Form 8822, Change of address, when notifying the IRS of an address change.

In addition, if you purchased health insurance coverage from the Health Insurance Marketplace, you may receive advance payment of the premium tax credit in 2014. It is important that you report changes in circumstances, such as when you move to a new address, to your Marketplace.

Questions?

If you’re still not sure whether your moving expenses are deductible, please give us a call. We’re here to help!

Reduce Your Taxes with Miscellaneous Deductions

If you itemize deductions on your tax return, you may be able to deduct certain miscellaneous expenses, which might reduce your federal income tax.

Examples include employee expenses and fees you pay for tax advice. If you itemize, these deductions could lower your tax bill. With that in mind, let’s take a closer look at miscellaneous deductions that might benefit you.

Deductions Subject to the Two Percent Limit. You can deduct most miscellaneous expenses only if they exceed two percent of your adjusted gross income. These include expenses such as:

- Unreimbursed employee expenses.

- Expenses related to searching for a new job in the same profession.

- Certain work clothes and uniforms.

- Tools needed for your job.

- Union dues.

- Work-related travel and transportation.

Deductions Not Subject to the Two Percent Limit. Some deductions are not subject to the two percent of AGI limit. Some expenses on this list include:

- Certain casualty and theft losses. This deduction applies if you held the damaged or stolen property for investment. Property that you hold for investment may include assets such as stocks, bonds and works of art.

- Gambling losses up to the amount of gambling winnings.

- Losses from Ponzi-type investment schemes.

Miscellaneous deductions are reported on Schedule A, Itemized Deductions. Be sure to keep records of your deductions as a reminder when you file your taxes next April.

Keep in mind that many expenses are not deductible. For example, you can’t deduct personal living or family expenses. If you have questions about whether your expenses are deductible or need assistance with Schedule A, don’t hesitate to give us a call.

Tips on Travel While Giving to Charity

Do you plan to donate your services to charity this this year? Will you travel as part of the service? If so, some travel expenses may help lower your taxes when you file your tax return next year. Here are five tax tips you should know if you travel while giving your services to charity.

1. You can’t deduct the value of your services that you give to charity, but you may be able to deduct some out-of-pocket costs that you pay to give your services–including the cost of travel. Out-of pocket costs must be:

- unreimbursed,

- directly connected with the services,

- expenses you had only because of the services you gave, and

- not personal, living or family expenses.

2. Your volunteer work must be for a qualified charity. Most groups other than churches and governments must apply to the IRS to become qualified. Ask the group about its IRS status before you donate. You can also ask us to check the group’s status. We are happy to do so.

3. Some types of travel do not qualify for a tax deduction. For example, you can’t deduct your costs if a significant part of the trip involves recreation or a vacation.

4. You can deduct your travel expenses if your work is real and substantial throughout the trip. You can’t deduct expenses if you only have nominal duties or do not have any duties for significant parts of the trip.

5. Deductible travel expenses may include:

- air, rail and bus transportation,

- car expenses,

- lodging costs,

- the cost of meals, and

- taxi or other transportation costs between the airport or station and your hotel.

Please contact us if you have any questions regarding tax deductions for charitable services.

Six Tips on Gambling Income and Losses

Whether you play the lottery, roll the dice, play cards, or bet on the ponies, all of your gambling winnings are taxable and must be reported on your tax return. If you’re a casual gambler, here’s what you need to know about figuring gambling income and loss.

1. Gambling income includes winnings from lotteries, raffles, horse races and casinos. It also includes cash and the fair market value of prizes you receive, such as cars and trips.

2. If you win, you may receive a Form W-2G, Certain Gambling Winnings, from the payer. The form reports the amount of your winnings to you and the IRS. The payer issues the form depending on the type of game you played, the amount of winnings, and other factors. You’ll also receive a Form W-2G if the payer withholds federal income tax from your winnings.

3. You must report all your gambling winnings as income on your federal income tax return. This is true even if you do not receive a Form W-2G.

4. If you’re a casual gambler, report your winnings on the “Other Income” line of your Form 1040, U. S. Individual Income Tax Return.

5. You may deduct your gambling losses on Schedule A, Itemized Deductions. The deduction is limited to the amount of your winnings. You must report your winnings as income and claim your allowable losses separately. You cannot reduce your winnings by your losses and report the difference.

6. You must keep accurate records of your gambling activity. This includes items such as receipts, tickets or statements. You should also keep a diary or log of your gambling activity. Your records should show your winnings separately from your losses.

If you have questions about gambling income and losses, don’t hesitate to call us.

Tips for Self-Employed Taxpayers

If you are an independent contractor or run your own business, there are a few basic things to know when it comes to your federal tax return. Here are six tips you should know about income from self-employment:

- Self-employment income can include income you received for part-time work. This is in addition to income from your regular job.

- You must file a Schedule C, Profit or Loss from Business, or Schedule C-EZ, Net Profit from Business, with your Form 1040.

- You may have to pay self-employment tax as well as income tax if you made a profit. Self-employment tax includes Social Security and Medicare taxes. Use Schedule SE, Self-Employment Tax, to figure the tax. Make sure to file the schedule with your tax return.

- You may need to make estimated tax payments. People typically make these payments on income that is not subject to withholding. You may be charged a penalty if you do not pay enough taxes throughout the year.

- You can deduct some expenses you paid to run your trade or business. You can deduct most business expenses in full, but some must be ‘capitalized.’ This means you can deduct a portion of the expense each year over a period of years.

- You can deduct business costs only if they are both ordinary and necessary. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and proper for your trade or business.

Questions? We have answers. Give us a call!

Customize Reports, Make Better Business Decisions

Do you remember why you started using QuickBooks?

You may have simply wanted to produce sales forms and record payments electronically, over time expanded your use of the software–perhaps paying and tracking bills through it and keeping an eagle eye on your inventory levels.

And, it’s likely that you’ve also run at least some of the pre-built report templates offered by all versions of QuickBooks since their inception.

QuickBooks’ automation of your daily bookkeeping tasks has undoubtedly served you well. But that’s merely limited use; now it’s time to take advantage of QuickBooks’ greatest strength: customizable reports.

One of the rewards for diligently entering all of your accounting information is a better grasp of your company’s financial performance to date. That insight ultimately leads to better business decisions that can contribute to your future growth and success.

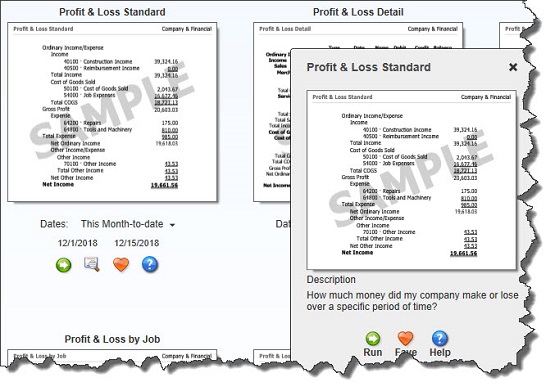

Figure 1: QuickBooks’ Report Center can help you learn about what each report is designed to tell you. But smart customization requires deeper insight.

Making Reports Meaningful

Like many other tasks in QuickBooks, report customization tools aren’t that difficult to master. What’s challenging is:

- Understanding what each report is designed to tell you

- Determining which reports are most relevant to your business information needs, and

- Designing each to produce the critical insight you need in order to move forward.

The first of these is fairly clear. You can understand what many reports do by their titles, their content, and the descriptions QuickBooks offers. We recommend that you spend some time looking at the Report Center in QuickBooks to familiarize yourself with your options.

The second two challenges are a bit more formidable. It’s our job to assist you in establishing a workflow in QuickBooks to keep accurate records and produce necessary transactions. But we want you to do more than just maintain the status quo. When you analyze and interpret what your reports are telling you, you can make smart business decisions.

So if we haven’t gone over this with you already, we encourage you to schedule some time with us so you can get the maximum benefit from your QuickBooks reports.

Figure 2: You can’t miss QuickBooks’ customization link when you open a report. But the trick is knowing how to best use its options for your business.

A Simple Set of Steps

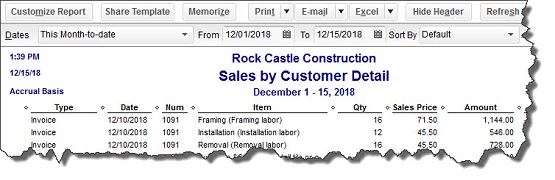

Let’s take a look at a report you may already be generate: Sales by Customer Detail (Reports | Sales | Sales by Customer Detail). QuickBooks comes with a commonly-used set of default columns in its reports. This particular report contains column labels like Type (invoice, sales receipt, etc.), Item and Quantity, and Sales Price.

You can easily change the date range that’s offered as a default up below the toolbar. But to get to QuickBooks’ powerful customization tools, click Customize Report. A window with four tabs opens. They are:

Display. Options in this window help you specify the columns you want to appear in your report. In the lower left corner, there’s a list titled Columns that contains every possible column label for that report. If you scroll down, you’ll see a check mark in front of the default columns. Click on any of those to uncheck them, and click in front of any that you’d like to add. Other options here include how your data should be totaled and sorted. Some reports let you choose between cash and accrual basis.

Filters. This is the difficult one–and the tool that will provide the most insight. Filters determine which subsets of related data you’ll see (accounts, items, customer types, zip codes, etc.) by including only those that meet certain conditions. Here’s where we can really help you answer critical business questions that will lead you to smart decisions.

Figure 3: In this example, you’ve created a filter that will find all commercial drywall jobs that have been invoiced in the current fiscal quarter. You could narrow this report further by, for example, class, state, and paid status.

Header/Footer and Fonts & Numbers. You can tailor the design and layout of your reports here.

Well-formulated reports can help you spot cash flow problems, maintain the right inventory levels, see which jobs are the most profitable, and compare your estimates to actual costs. You’ll also be able to identify your best customers, your most sought-after items, and your most successful sales reps. Careful customization of your reports–and thorough analysis of their data–will make the answers to your constant questions about your company’s future direction much clearer. We can help you take full advantage of these powerful tools.

Tax Due Dates for October 2014

October 10

Employees who work for tips – If you received $20 or more in tips during September, report them to your employer. You can use Form 4070.

October 15

Individuals – If you have an automatic 6-month extension to file your income tax return for 2013, file Form 1040, 1040A, or 1040EZ and pay any tax, interest, and penalties due.

Electing Large Partnerships – File a 2013 calendar-year return (Form 1065-B). This due date applies only if you were given an additional 6-month extension. See March 17 for the due date for furnishing the Schedules K-1 to the partners.

Employers (nonpayroll withholding) – If the monthly deposit rule applies, deposit the tax for payments in September.

Employers (Social Security, Medicare, and withheld income tax) – If the monthly deposit rule applies, deposit the tax for payments in September.

October 31

Employers – Social Security, Medicare, and withheld income tax. File form 941 for the third quarter of 2014. Deposit any undeposited tax. (If your tax liability is less than $2,500, you can pay it in full with a timely filed return.) If you deposited the tax for the quarter in full and on time, you have until November 10 to file the return.

Certain Small Employers – Deposit any undeposited tax if your tax liability is $2,500 or more for 2014 but less than $2,500 for the third quarter.

Employers – Federal Unemployment Tax. Deposit the tax owed through September if more than $500.

Copyright © 2014 All materials contained in this document are protected by U.S. and international copyright laws. All other trade names, trademarks, registered trademarks and service marks are the property of their respective owners.

MARK ARONOFF, CPA, P.C.

122-39 Mowbray Drive

Kew Gardens, NY 11415

Phone: (718) 775-5868

mark@aronoffcpa.com